How to Put Your Finances in Order: 5 Rules for Business

Last modified:

90% of new companies close within their first year📊 One of the main reasons is poor financial management or even its absence.

Let’s take a look at the rules you should follow to get your financial accounting in order and establish a basic management scheme for your business 🧐

1. Automatize Financial Accounting

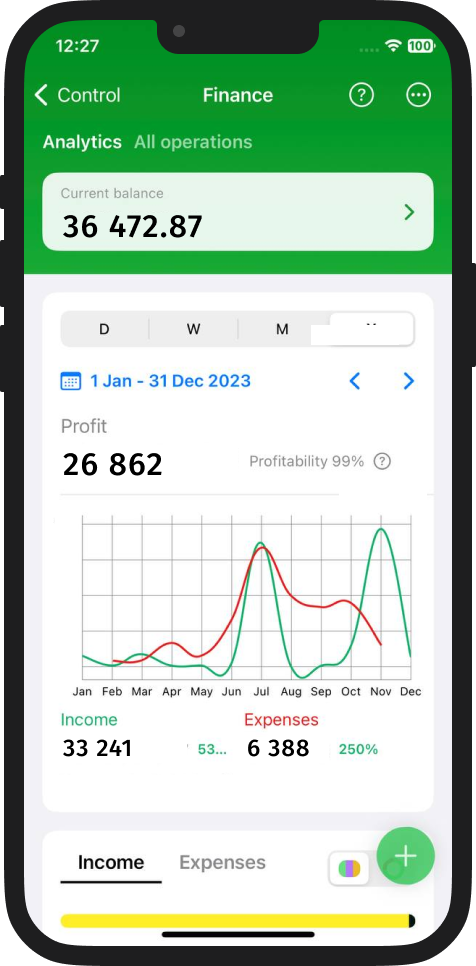

Choose software that is convenient and understandable for you, also suitable for the tasks and size of your business. The DIKIDI program has all the necessary functionality for businesses.

For example, the “Finance” section is designed to conduct financial accounting easier and faster:

⚙️ all income & expense operations are in one place, and it’s convenient to add them directly from your phone;

⚙️ formulas and graphs are generated automatically by the system;

⚙️ the functionality is intuitive and doesn’t require a whole IT department for setting it up.

2. Separate Your Personal and Company Funds

It is necessary to avoid situations where you need to purchase work materials or pay employee salaries, but the money has been spent on repairing your apartment 😌 To separate financial flows, set a salary for yourself and transfer it to your personal account on a monthly basis.

The "Salary" section in DIKIDI can help you automatically calculate and pay salaries to yourself and your employees. Learn more

3. Track All Income & Expenses Immediately

To manage finances properly, consistency is key. Track all expenses and income immediately, without further delay✍️ This way, you won't find yourself in a situation where expenses are much higher than expected.

4. Categorize Transactions

If income and expense items are too generalized, it can be difficult to understand where the business is losing money and what can be optimized. Categorize transactions so that you can analyze changes and sharp fluctuations 📈

In DIKIDI, you can add your own transaction categories in the “Finance” section and color them. Then, simply choose a type of transaction: income or expenses.

5. Analyze Sales & Sum Up Results

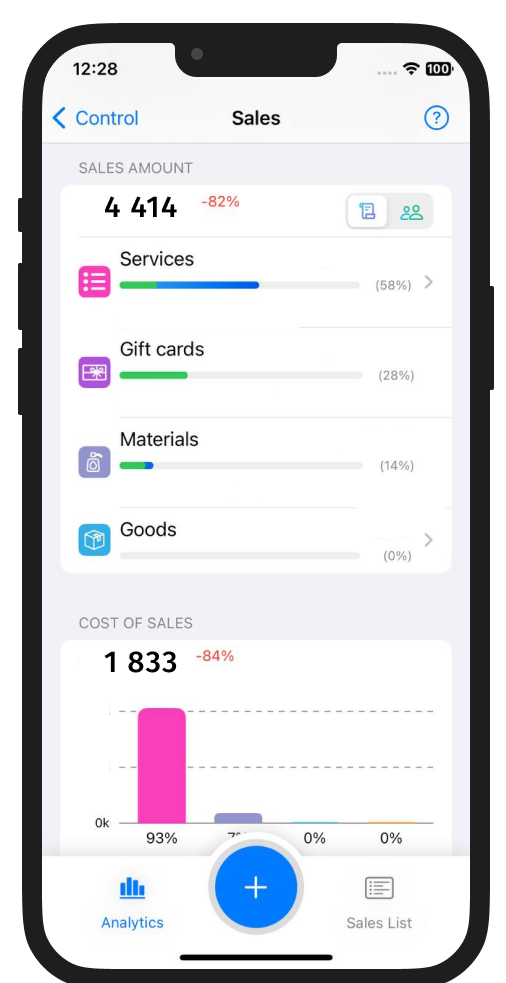

Analyzing business performance helps in making effective decisions, including adjusting plans and employee work.

The "Sales" section in DIKIDI will automatically generate analytics and display the data in reports (by services, products, employees).

Based on the analytics from the "Sales" section, you can:

📌 evaluate the efficiency of your employees;

📌 monitor the demand and manage your list of services;

📌 obtain up-to-date reports on sales and revenue;

📌 track the most important business metrics (efficiency, profit, prime cost).

Thus, automating finances and regularly analyzing sales help entrepreneurs control business processes and make sound decisions. Following these rules increases the chances of long-term success.

The "Finance" and "Sales" sections are available in the LITE, PRO, and VIP plans.

Read also: